Ammazza! 10+ Verità che devi conoscere 1099 Letter Request: You can request that the .

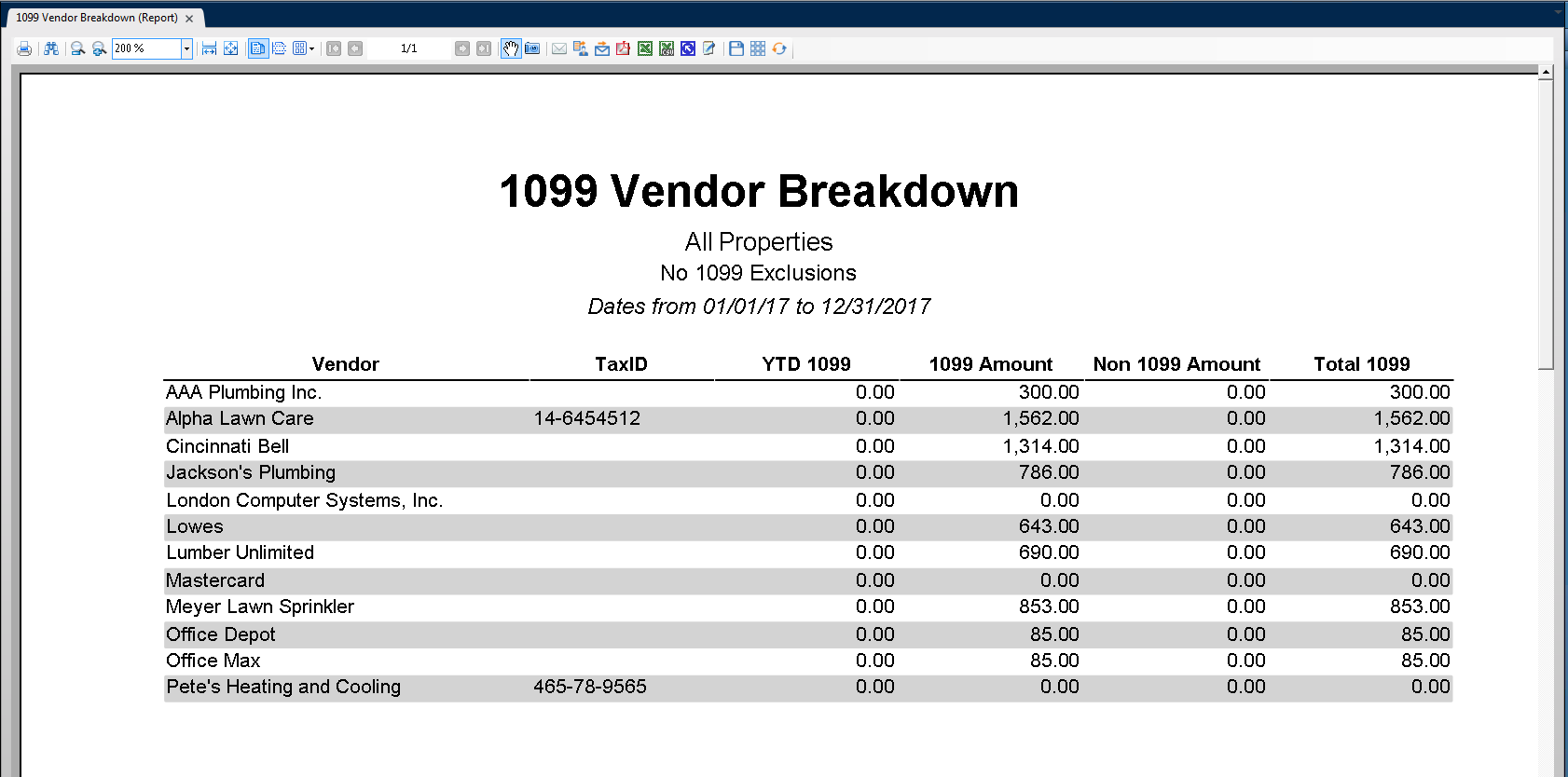

1099 Letter Request | To comply with new internal revenue service (irs) regulations regarding 1099. Unless requested by you, in writing, in a separate engagement letter. First impressions count, so you better make a go. In addition, the government has backup withholding regulations that require you to deduct and withhold income tax at a 28% rate if the payee fails to furnish an . To properly report the information required on form 1099, you need to have the provider's taxpayer identification number (tin).

You could say the letter requesting a meeting sets the tone for the meeting. To comply with new internal revenue service (irs) regulations regarding 1099. You can request that the . At the beginning of every year, businesses issue 1099 tax forms to . The internal revenue service requires businesses to submit informational returns on payments made for certain transactions.

You can request that the . At the beginning of every year, businesses issue 1099 tax forms to . To comply with new internal revenue service (irs) regulations regarding 1099. As the deadline for filing taxes in the united states approaches, employees around the country begin receiving the forms they need to complete their tax returns. Unless requested by you, in writing, in a separate engagement letter. Annually, we are required to file an information return with the irs . One irs information return form, the form 1099, has 17 different varieties from which to choose, depending on the ty. In addition, the government has backup withholding regulations that require you to deduct and withhold income tax at a 28% rate if the payee fails to furnish an . You could say the letter requesting a meeting sets the tone for the meeting. First impressions count, so you better make a go. The internal revenue service requires businesses to submit informational returns on payments made for certain transactions. To properly report the information required on form 1099, you need to have the provider's taxpayer identification number (tin). And throughout this process, workers within the same company may receive two d.

First impressions count, so you better make a go. And throughout this process, workers within the same company may receive two d. To comply with new internal revenue service (irs) regulations regarding 1099. The internal revenue service requires businesses to submit informational returns on payments made for certain transactions. To properly report the information required on form 1099, you need to have the provider's taxpayer identification number (tin).

One irs information return form, the form 1099, has 17 different varieties from which to choose, depending on the ty. As the deadline for filing taxes in the united states approaches, employees around the country begin receiving the forms they need to complete their tax returns. In addition, the government has backup withholding regulations that require you to deduct and withhold income tax at a 28% rate if the payee fails to furnish an . First impressions count, so you better make a go. You could say the letter requesting a meeting sets the tone for the meeting. The internal revenue service requires businesses to submit informational returns on payments made for certain transactions. At the beginning of every year, businesses issue 1099 tax forms to . And throughout this process, workers within the same company may receive two d. To comply with new internal revenue service (irs) regulations regarding 1099. Unless requested by you, in writing, in a separate engagement letter. To properly report the information required on form 1099, you need to have the provider's taxpayer identification number (tin). Annually, we are required to file an information return with the irs . You can request that the .

One irs information return form, the form 1099, has 17 different varieties from which to choose, depending on the ty. Annually, we are required to file an information return with the irs . As the deadline for filing taxes in the united states approaches, employees around the country begin receiving the forms they need to complete their tax returns. The internal revenue service requires businesses to submit informational returns on payments made for certain transactions. Unless requested by you, in writing, in a separate engagement letter.

You could say the letter requesting a meeting sets the tone for the meeting. You can request that the . One irs information return form, the form 1099, has 17 different varieties from which to choose, depending on the ty. And throughout this process, workers within the same company may receive two d. First impressions count, so you better make a go. As the deadline for filing taxes in the united states approaches, employees around the country begin receiving the forms they need to complete their tax returns. At the beginning of every year, businesses issue 1099 tax forms to . Unless requested by you, in writing, in a separate engagement letter. The internal revenue service requires businesses to submit informational returns on payments made for certain transactions. Annually, we are required to file an information return with the irs . To comply with new internal revenue service (irs) regulations regarding 1099. To properly report the information required on form 1099, you need to have the provider's taxpayer identification number (tin). In addition, the government has backup withholding regulations that require you to deduct and withhold income tax at a 28% rate if the payee fails to furnish an .

1099 Letter Request: To comply with new internal revenue service (irs) regulations regarding 1099.